As chief financial officer for the Cleveland Metropolitan School District in Ohio, Derek Richey knows historical financial data isn’t enough to plan for any unforeseen events or shifts that might impact the district.

“Past revenue and expenditure trends are valuable information,” he says, “but are not sufficient to prepare the larger organization for financial stability.”

That forward-looking approach is one of three mindsets today’s district CFOs need to “help their leadership teams make crucial tradeoffs to ensure maximum return on student outcomes,” according to a new guide from Education Resource Strategies, a nonprofit focused on how district and school leaders use people, time and money to help more students achieve academic success.

In CMSD, Richey’s team prepares a five-year forecast of projected revenues and expenses.

“We take into account projected enrollment shifts, state and federal funding changes, and other things that may impact revenue and expenditures,” he says. “We share this information with the board and senior leaders so financial management becomes something everyone does.”

Looking forward also includes tracking spending connected to a particular effort or department, and following through on the implementation of specific initiatives.

The guide quotes the CFO of an urban, mid-Atlantic district as saying, “The CFO needs to stop people from flipping to the shiny new thing they saw at a conference.”

Reach outward

CFOs are public figures. They can help build support in the community for district initiatives by educating school board members, community leaders, parents and other members of the public “about the ‘why’ behind the numbers,” the guide says.

“A strategic CFO,” the guide says, “has a specific set of financial management responsibilities, but ultimately defines her own success as driven by the system’s progress toward its goals.”

The guide includes the voice of a CFO in an urban district who says CFOs can serve as "almost an internal consulting firm" within the district and an "overall problem-solving resource" for departments as they build their strategies.

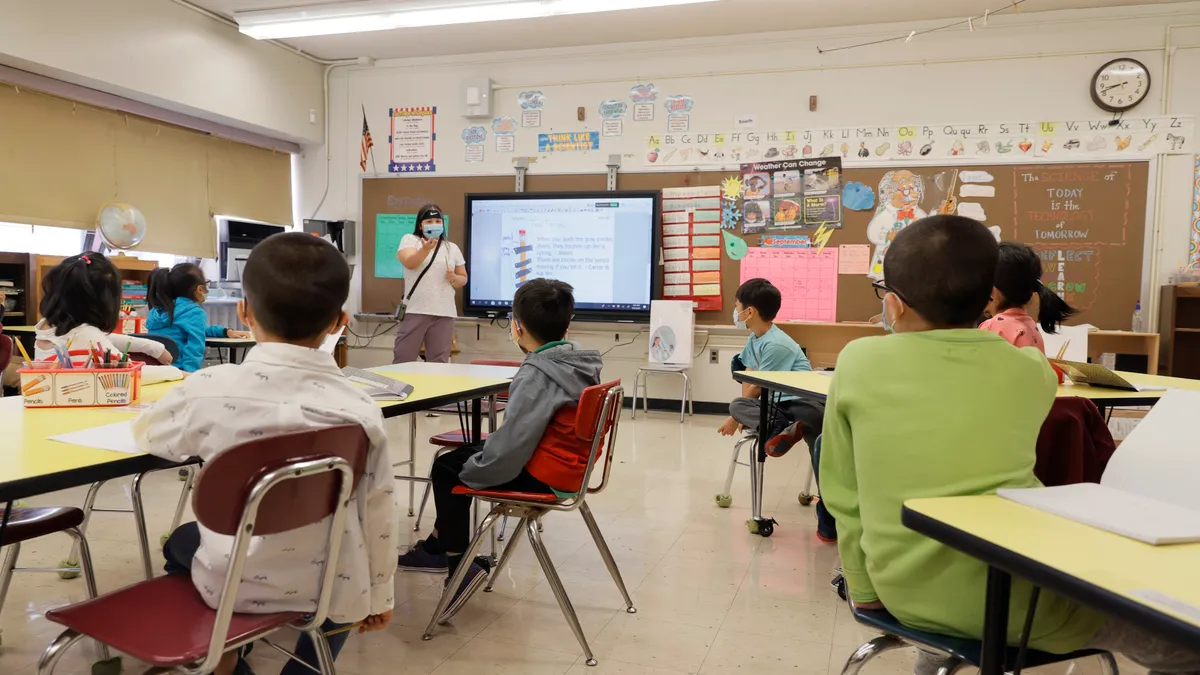

Focus on equity

Aligning spending with a district’s goals can result in resources being allocated to schools depending on their unique needs. “Across the board” increases or reductions are unlikely to help the district achieve its goals, the guide says, and CFOs can help shift the conversation from fairness to equity.

“Departments do not all have the same underlying cost structures or play the same role in relation to various priorities,” according to the guide. And larger schools or those struggling in a certain area will likely need additional resources.

In CMSD, funds are allocated to schools based on a weighted formula. “This allows us to account for shifts in enrollment and demographics,” Richey says, “in pursuit of an equitable distribution aligned to desired student outcomes.”

Providing 'a common language'

ERS has brought together district finance leaders for over 10 years, explains Jonathan Travers, a partner with the organization and the lead author of the publication. Many are among the more than 10,000 educators, district personnel and community members who have played ERS' Budget Hold 'Em game since 2011. The game simulates the type of tradeoffs and decisions district leaders have to make when finalizing a real budget.

"The reality is that the challenges facing our nation’s school systems demand a transformation in financial leadership," Travers says. "CFOs must meet the foundational expectations of strong financial management that is critical to the district’s financial health, but they also have primary responsibility for ensuring systems align limited resource and effective strategy sustainably over time."

The guide, he adds, provides "a common language for district leaders that are focused on this kind of transformational leadership."

CFOs have traditionally been responsible for balancing budgets, producing reports and complying with financial regulations.

“But today’s CFO is part of a district leadership team that is on the hook for so much more,” the authors write, adding while policymakers have set a higher bar for student learning, revenues for education are often flat or declining.

The guide provides details on the core functions of a CFO’s job — long-term financial planning, strategic planning, annual district budgeting, annual school budgeting and collective bargaining. The guide also compares typical practices to more strategic approaches.

For example, a traditional budget might be organized by departments within the district, while a “strategic CFO” would organize the budget by program or strategy. “This allows stakeholders to clearly see how the district is funding its big priorities,” the authors write.

They highlight Philadelphia Public Schools, which allocated funds “through the lens of early literacy outcomes” because district leaders set the goal of improving student achievement in this area. They also monitored spending and student outcomes at each school to determine which strategies or professional development activities were most effective.