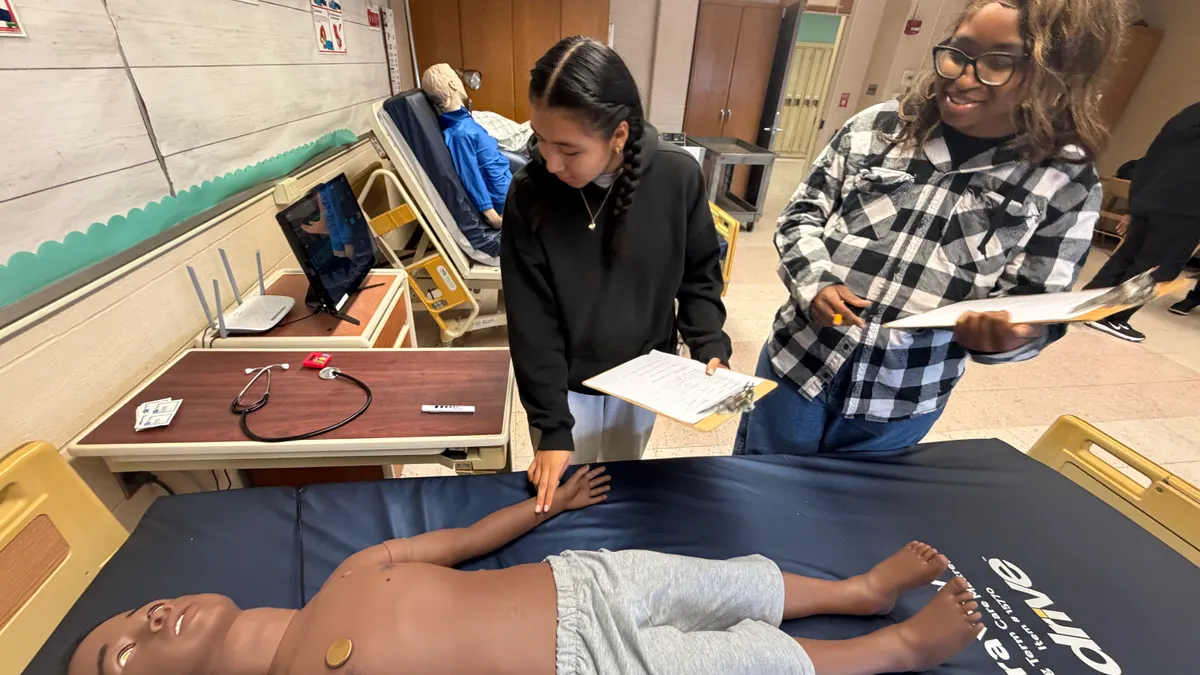

To Dustin Voss, every financial literacy lesson starts with one crucial tool — teaching students how to think about money.

“They can learn discreet information about banks and interest rates,” says Voss, a teacher at Christian Fenger Academy High School in Chicago, IL, for the past seven years. “But it’s unlikely they will remember that. What’s important is for them to start thinking in a different way.”

Few would disagree that teaching financial literacy to K-12 students — many of whom were not born until after the financial crisis that swept the U.S. in 2008 — is important. But the deep recession that took hold of the country had some roots in financial decisions made by consumers. Voss believes students should be thoughtful in how these choices were made, so they don’t repeat them.

Recent graduates appear to agree. Money management is a class 18-to-24-year-olds in 49 states said they wish they’d had the option of taking in school, according to Vince Shorb, CEO of the National Financial Educators Council. Working with colleges, K-12 schools and community organizations to bring financial literacy to students, the group, based in Lake Tahoe, NV, surveyed 8,600 recent graduates over two years.

“During the high school years, there is more of a pressing need,” Shorb says. “It is about helping them achieve some security.”

Lessons can be taught, however, to students as young as elementary school. Around the concept of lending money, for example, children are asked to remember when they’ve lent something to a friend. Was that item returned in good condition? If so, a child may be more likely to let that friend borrow from them again. “And that develops the core ideas around credit,” he says.

In some states, these lessons around money and finances are required. But that doesn’t mean they’re doing a good job, says the Center for Financial Literacy at Champlain College.

In a year-end survey, the center rated how well all 50 states and the District of Columbia were educating high school students. The majority of states, 27, earned a C, D or F for their efforts — with California, Massachusetts and Wisconsin among the worst. Not surprisingly, knowing how to balance a checking account, pay a bill, or build a solid credit rating doesn’t always work its way into algebra, history or Spanish classes.

Closing the financial gap

Originally assigned to teach an economic course at his 9-12 high school in Chicago, Voss took the class in a different bend — bringing in more personal finance lessons. He also challenged students to think about their own financial decisions, as well as those he knew they would have to make on their own in just a few short years, like choosing a bank for a future checking account.

These lessons became the launching point for Chicago Public Schools’ online curriculum around financial literacy that Voss helped build. Superintendents and principals can download the material on their own and apply the structure to their own districts and schools.

“We wanted to make it easy for principals to assign the materials to a teacher,” he says. “We needed to make sure they could do it. Because even though Illinois has a graduation requirement around financial education, there’s no real teeth if it’s not being done.”

Educators can also turn to programs from private groups such as Pathway to Financial Success in Schools, a co-launch from banking and credit card company Discover Financial Services and Discovery Education that launched in November and is distributed for free online.

Designed for high school students, courses are broken into eight online lessons that teachers can weave into existing classes. Subjects include how to make a budget for future goals, balance a checking account, open a savings account, and how to think about financing their higher education plans.

“Homework is brought home and kids are asking to get their parents involved,” says Matthew Towson, director of community affairs at Discover. “Filling out the FAFSA, for example, is something students can do with their parents.”

For some students, though, it’s teachers they return to with questions, such as how to set up a 401K when they bring home that first paycheck. Voss says he hears at least once a month from graduates as they start to build their own financial lives.

"They remember taking my class, and they ask me about banking or how to invest," he says. "They want to make sure they’re doing it right."

Dive Awards

Dive Awards