Dive Brief:

-

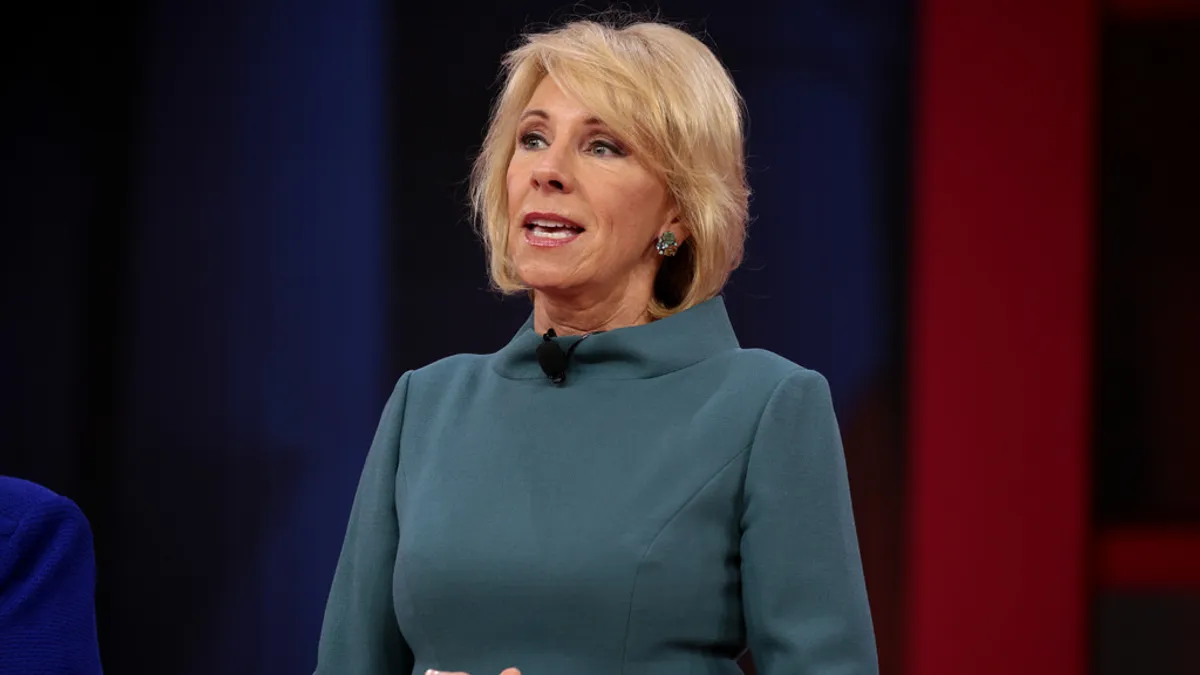

U.S. Secretary of Education Betsy DeVos announced Thursday in a press release that the Department of Education is contracting with a Maryland business management consulting firm to support the expansion of public charter schools in economically distressed areas.

-

The new push to expand charter schools in these communities, designated as "opportunity zones" under the Tax Cuts and Jobs Act of 2017, is meant to create additional education options for families from low-income backgrounds, according to the release.

-

In the announcement, DeVos stated she expects the expansion of charter schools to have a "long-lasting impact" on the communities.

Dive Insight:

Currently, 70% of opportunity zones do not have a public charter school option, and one-fifth of the residents in these areas have not graduated high school. With charter growth steadily slowing overall in the past few years — the annual rate of growth reached an all-time low at just 1% during the 2017-18 school year — politicians and advocates have been pushing for ways to spur new growth.

This new opportunity to fund charter schools arose under President Donald Trump, who signed the Tax Cuts and Job Growth Act in 2017, establishing opportunity zones and allotting federal funds to incentivize investment by offering tax benefits to those willing to pour resources into low-income, high-poverty areas.

Florida is among states that have sought to take advantage of the program by linking state charters to the federal program. In February, Gov. Ron DeSantis even proposed additional incentives aside from the tax breaks, like money for construction, if investors agreed to build charters in the zones. He also proposed loosening other requirements to allow a “five-fold expansion.”

According to a 2018 report by the National Charter School Resource Center, charter schools in 44 states have the potential to finance via opportunity zone tax breaks. The report estimates that between 1,078 and 2,079 schools could use the program to fund new buildings or renovations.

While proponents of charters see this as a chance to support expansion, opponents of opportunity zones have argued place-based tax breaks have a poor history of helping the low-income areas they are meant to improve and may actually hurt overall. As noted by Education Next, this could mean large tax giveaways are provided to investors to pour resources into pipeline projects they would have pursued anyway, discouraging them from taking on challenging projects like creating charter schools in struggling communities.

“Investors could flock to the projects that have known deal pipelines, such as real estate, in the markets they know best, such as major metropolitan areas,” John Bailey, advisor to the Walton Family Foundation, notes.

History has shown this, in turn, could lead to gentrification, displacement and concentrated areas of poverty.

Still, if even a sliver of the $6 trillion in unrealized capital gains that opportunity zones allow is directed toward charter school development, it could still be significantly more than past investments. The Community Development Financial Instutition, which oversees a similar federal incentive program called New Markets Tax Credit, estimates that since its inception and through 2017, only $189.7 million has been directed toward charter schools.

But Adam Pashek, Vice President of Advocacy at ExcelinEd, notes that even if “just one-tenth of 1%” of funds allowed by opportunity zones are invested in charter growth, that would be significantly greater when compared to any previous investments produced for charters by New Markets Tax Credits.

In 2019, the Education Department awarded over $3.8 million in funding to applicants looking to invest in opportunity zones, with “preference priority” given to two of its charter school grant programs.

Dive Awards

Dive Awards