Demi Ross is vice president of admissions operations & finances at Teach For America. Charles Walker is president and founder of Intelligent Technologies, and a board member with 100 Black Men of America, one of the nation’s top African American-led mentoring organizations.

Confidence breeds success.

That adage applies to everyone, including those we rely on to impart knowledge — and confidence — to others: teachers.

Consider the case of a social studies teacher we’ll call Janice. A mother of two, and a budget-conscious homeowner who is tackling her student loan debt while prudently saving for retirement, she is financially literate by any definition of the term. But is Janice confident she could teach a class in personal finance at her low-income high school?

Not really. And she’s not alone.

For years, teachers haven’t spent much time teaching students about personal finance. And that’s primarily because they weren’t confident in teaching the topic themselves. One prominent study found only 9% of teachers in 2009 felt equipped to teach personal finance, and just 30% of teachers had ever taught financial literacy.

Fast-forward to 2020 and we see a significant change: 70% of teachers felt very confident in teaching personal finance. That added confidence translated to action in the classroom, as 42% have taught a standalone course in personal finance, and 28% have taught personal finance material within another course.

Why the turnaround? There are many factors, among them an increase in the availability of low-cost professional development courses as well as more states requiring personal finance to be taught in schools. The point is a combination of efforts helped address the problem of having too few educators who felt prepared and confident to teach personal finance.

Systemic racism has played a major role in preventing widespread access to financial tools and institutions. For low-income communities and communities of color, this, in turn, prevents people from building wealth and securing financing or saving for retirement.

Increasing access to financial literacy is a significant step to overcoming the disparities in wealth by race and ethnicity that are so prevalent in our society. It’s our belief that non-profit organizations like ours (Teach For America and 100 Black Men of America), government agencies and corporations should play a role in helping to reduce the racial wealth gap that exists in our nation.

However, financial literacy isn’t an all-or-nothing concept. Quite often, the best budgeters you’ll ever meet are individuals or families, who must stretch every dollar to cover the costs of food, utilities and shelter. And that’s in part because being in a low-income bracket is expensive and requires increased expenditures — necessitating skill and finesse to manage day-to-day expenses on a limited income. But those same individuals may have little knowledge of more advanced financial management tools, resources or investment opportunities that could help place them in firm financial footing.

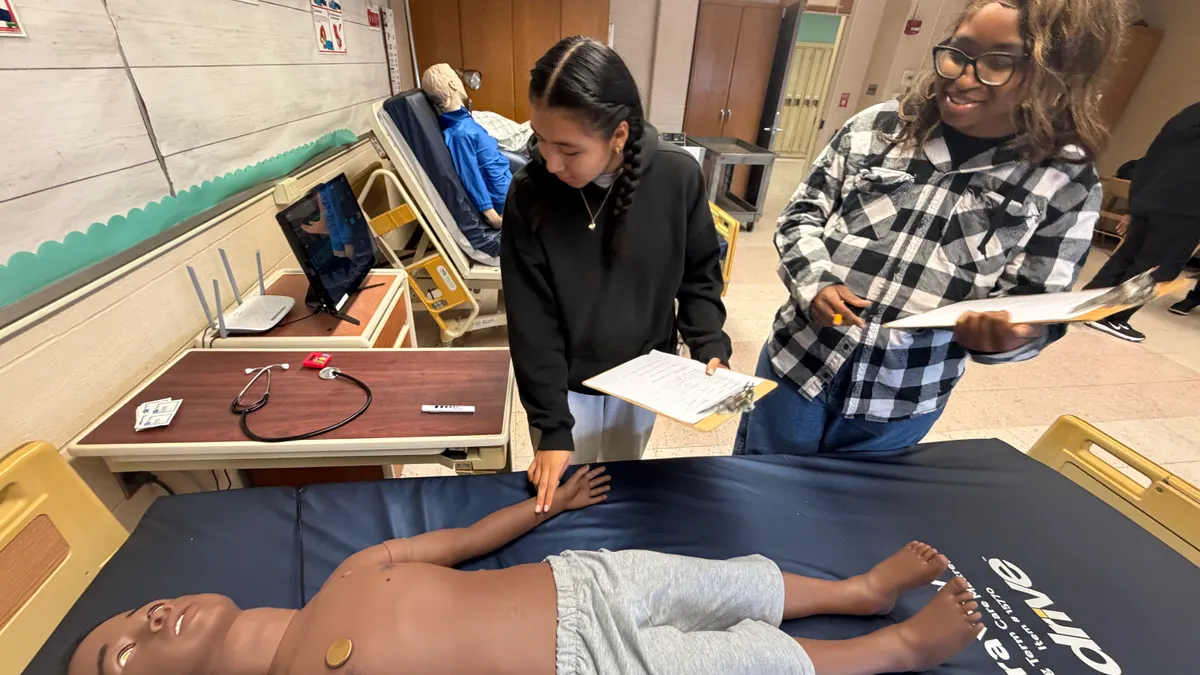

Overcoming these barriers requires a multi-faceted approach from stakeholders, including corporate social responsibility programs. Could organizations like Teach For America and 100 Black Men use funding and in-school volunteers to help broaden understanding of finances at an early age? Absolutely.

But the effort must go beyond fund-raising or short-term educational campaigns, as important as they are. We need more than awareness to overcome race- and class-driven financial inequities.

How can corporations help? One way is to pause, reflect and listen to what’s happening in their communities, as many did amid the COVID-19 pandemic and social unrest that roiled the nation in 2020. For instance, Fidelity Investments — a supporter of both of our organizations — held listening sessions with more than 60 organizations. Those engagements revealed a need for Fidelity to better understand communities in order to be responsive and build partnerships that actively support those needs.

As a result, Fidelity is refining its community-focused financial literacy program by developing and launching Fidelity Financial Forward, a website offering educators, parents and anyone with a vested interest in a child’s education with the tools to teach the nuances of financial management.

That may seem like a small step, but we think it will reap huge rewards. Studies reveal children are beginning to understand the concept of money by age 6, so teaching them the basics of finance at an early age will reap tangible benefits throughout their lives. As more teachers — inside and outside the classroom — have the confidence and resources to share financial learnings, more young people will be empowered to advance their own financial futures.

There are many other factors that contribute to the racial wealth gap, and it will take additional wide-scale interventions to make our financial systems more inclusive. But this approach, one of collective engagement to broaden financial literacy, is one step toward opening up opportunities for our youth.

Dive Awards

Dive Awards