Sheron Myers is always on the road. As the senior financial education specialist (K-12) for Virginia Credit Union, Myers travels to elementary, middle and high schools in the Richmond, Virginia, area and surrounding counties to help students get up to speed on the subject of personal finance. To her, there’s never an age too young to learn the value of money — and she says students understand far more, in terms of financial details, than adults give them credit for knowing.

“They even know in the 1st grade what a debit card is, how it’s used, and what a PIN card is,” said Myers, who has also worked as a kindergarten teacher. “They even know the proper term.”

Financial literacy was once the terrain of home economics classes, taught in schools along with other life skills from cooking to woodworking. While shop classes may be seeing a resurgence in some districts, not all require that students graduate with the ability to balance a checkbook or finance a car. Today, parents are often expected to fill in the blanks — but when families don’t explain how to pay bills or how to keep a budget, some students are left without the tools to handle money successfully as adults.

“In the 1950s, students had home economics classes,” Vince Shorb, CEO of the National Financial Educators Council (NEFC), told Education Dive. “So, we know 100% of students need to manage their money, and it’s shocking these skills are not still taught.”

Modular approaches

Today, financial basics are delivered during single lectures, often as standalone classes, folded into a math or social studies curriculum. Just 17 states require high school students to take a course in personal finance, according to the 2018 Survey of the States by the Council for Economic Education. And some states — including California, Alaska, Montana and Wyoming, as well as the District of Columbia — don’t even include personal finance curriculum as part of their standards.

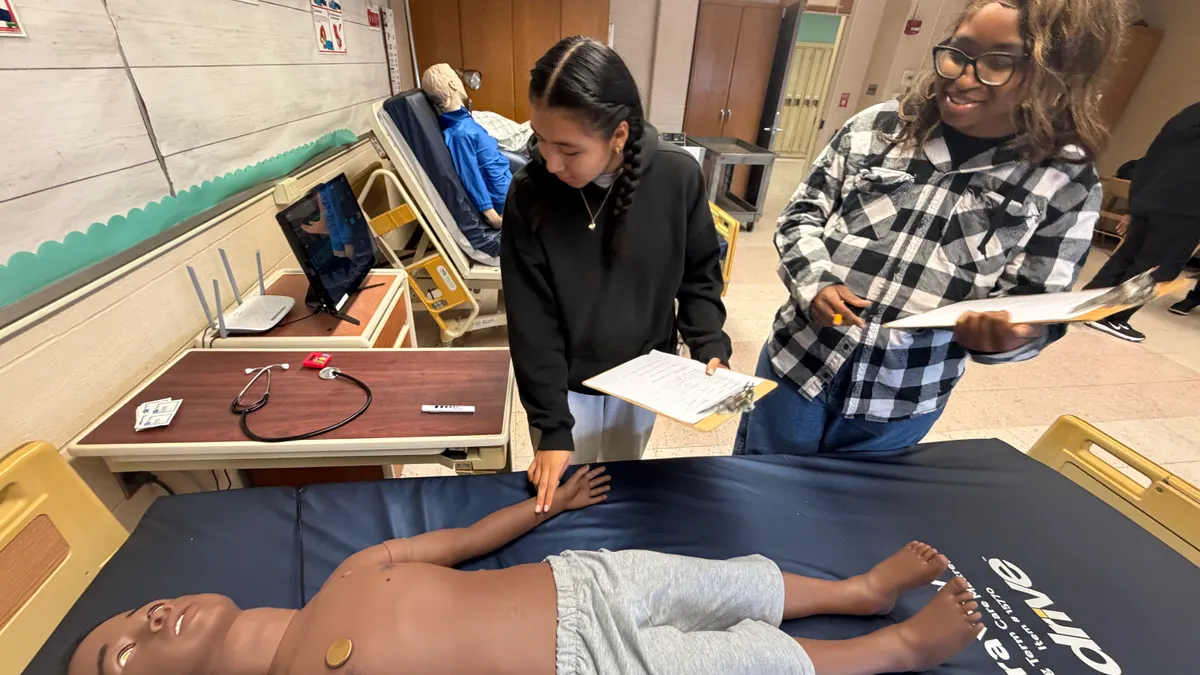

Myers being welcomed into schools is helped, in part, by the personal finance requirement for every public high school student in the state of Virginia, she said.

Organizations such as the Virginia Credit Union are also choosing to underwrite financial literacy programs as part of community partnerships, which means the programs are free for schools. In some cases, these programs are also offered at a national level, and while they certainly bring more visibility to the financial institutions involved, they’re also delivering some much-needed financial know-how to students in a way that teachers can more easily add them to existing courses.

I think the younger you can introduce this concept, the better they will be ... If our goal is to get them to be financially successful, [and] if they don’t have tools, how can they be?

Sheron Myers

Senior financial education specialist (K-12), Virginia Credit Union

At Brain Arts Productions, which creates financial literacy classes for schools, programs are designed to work across any curriculum from math to social studies — but mainly taught as individual classes, Victoria Golden, the company's program director, told Education Dive. The group also hopes these tools make their way back to parents and caregivers when materials are brought back home from school.

“Parents love having that insight into the classes, and we've heard from many people that they had conversations with their spouse or other family members that they wouldn't have had before,” Golden said. “Having school be a starting point for financial literacy means that everyone can be educated — not just children with families who have a deep understanding of money matters, but entire families.”

An application for every grade

For students whose families may not have the tools on how to manage their finances, the lessons learned can be crucial. Myers notes the classes Virginia Credit Union offers run the spectrum from understanding what a salary is as compared to an hourly wage, to knowing how to buy a home.

She says starting financial literacy classes with students as young as possible is important, especially if parents aren’t supplementing these tools, as well. For example, if elementary-aged students never learn why building a savings account is important, then when they start to get an allowance in their middle school years, they may never learn the concept of putting aside money.

“I think the younger you can introduce this concept, the better they will be,” she said. “If our goal is to get them to be financially successful, [and] if they don’t have tools, how can they be?”

In Virginia, teachers are also offered training classes in the summer and a couple of times throughout the year, taught in partnership by Virginia Credit Union and other financial institutions in the area, so they have the tools needed to give students the learning they require.

Ultimately, Myers understands that a class on budgeting may not be the subject that gets students the most animated when they walk through the door — but she also knows it’s certainly the one tool she knows they’ll be able to use when they leave school.

“When you’re in high school, I don’t know if [financial literacy] are their favorite classes, but I think they find it’s the most useful,” she said. “Maybe not while they're in it, but I think they graduate with an advantage.”

Dive Awards

Dive Awards