Between 2001 and 2018, the proportion of state education funding used to pay teacher retirement costs increased from 7.5% to 14.4%, creating a tug of war between pension liabilities and spending on teacher raises, lower class sizes, and programs for students, such as arts, sports and other enrichment opportunities, according to a report released Tuesday.

Over that same time period — which included “slashed allocations to school districts” because of the Great Recession — pension debt climbed from less than $20 billion to over $640 billion, representing a type of “hidden K-12 funding cut,” wrote Jonathan Moody and Anthony Randazzo of the Equable Institute, a nonprofit focusing on retirement plan sustainability.

And now, with the stock market losses brought on by the pandemic, pension costs for states will only continue to increase, and states will have less money to pay down the debt.

“The recession will elevate the pension problem,” Marguerite Roza, a research associate professor and director of Georgetown University’s Edunomics Lab, said last week during a webinar on COVID-19’s impact on state education funding.

Moody and Randazzo don’t pin the blame on pensions themselves or attribute the costs to generous contracts with teachers. The problem, they wrote, is “apathy toward growing shortfalls in pension funding” and faulty assumptions about investment returns or increasing life expectancy rates.

The report highlights the South Dakota Retirement System as one example of a modern and well-managed pension fund based on “realistic investment assumptions” and built for “a more mobile workforce.”

States also typically pay for pension obligations out of K-12 education budgets instead of the general fund, which further pits pension debt against schools, Randazzo said. He recommends states stop asking districts to pay the debt and move those payments out of the education budget.

“The payoff for that heavy lifting would be full transparency at the state level of what is being spent to pay down pension debt, while keeping all normal pension costs that are a part of any compensation expense with K-12 employers,” he said.

An ‘unintended consequence’

And speaking of transparency, a new research brief released last week adds another layer to the pension issue — the cases in which states subsidize the “employer contribution” toward retirement savings. In the brief, University of Arkansas Professor Robert Costrell and co-authors write 23 states cover that cost for districts, which serves as another type of state aid — roughly $19.2 billion nationally in fiscal year 2018. For comparison, that figure was $3.4 billion more than federal Title I funding.

An “unintended consequence” of this method is larger subsidies go to low-poverty districts that can afford to pay higher teacher salaries, running “completely counter to the progressive purpose” of state funding formulas meant to shift more education funding toward schools and students with the greatest needs.

Because states have postponed pension payments, those subsidies become even larger, “and so do the inequities,” the authors wrote.

Under the federal Every Student Succeeds Act, states and districts are now required to report per-pupil expenditures of federal, state and local dollars, adhering to standards set by the Government Accounting Standards Board, a non-governmental organization. In 2012, GASB required that pension plans report “non-employer” contributions, making such data on subsidies now available.

Steps for district leaders

The question is whether district leaders can do anything about pension debt when state officials are the ones who decide on pension fund contributions. The experts provide some steps educators can take:

- Tell a story. District and school leaders, Randazzo said, can document what they are unable to fund because of pension costs. “At the very least, we need more stories about the lives this is affecting to make this challenge visible and urgent,” he said. “We need to know what kind of teacher salary increases districts could otherwise offer if not for teacher pension debt contributions. We need to know what programs are getting cut each year when pension contributions increase and how this affects education equity.”

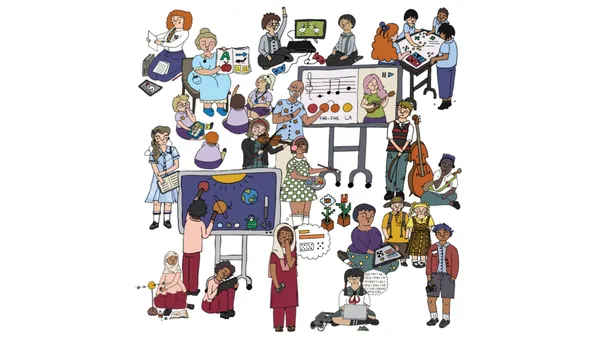

Pivot Learning, a California nonprofit, provided such stories in a report last year. “To cover growing unfunded pension costs, school districts are making harmful cuts and compromises,” wrote the authors of “The Big Squeeze,” noting, for example, 35% of districts in the state had raised class sizes, 33% had cut enrichment programs, and 19% had reduced counseling and mental health services for students.

- Make raises non-pensionable. During a recession, district leaders can make raises non-pensionable and, therefore, not able to drive up the debt even further, suggested Roza. In the contract reached last fall with the Chicago Teachers Union, for example, the city stipulated $25 million for veteran teachers in the Chicago Public Schools would be paid in the form of bonuses, not as part of a salary increase.

Roza added because the value of most retirement accounts is dropping now because of the economic downturn, “it doesn’t make sense to drive up teacher pensions during this time.”

- Voice concerns to policymakers. Randazzo also urges district leaders to advocate for shifting the costs of unfunded pension liabilities to the state level. This is the current policy in Maryland. “Pension fund management is outside the control of districts, and the costs of backfilling shortfalls should be managed at a state level,” he said.

- Create long-term budget forecasts. Funding levels can change from year to year — as superintendents and principals well know. But Randazzo recommends applying some “pension contribution stress tests” to measure how pension contribution rates of 1%, 2% or 3%, for example, would affect the budget.

“The key point is that districts should develop a conceptual plan for if contribution rates increase and make all stakeholders aware of those risks,” he said. The Pivot Learning report also recommends districts make realistic budget decisions. They might want to give teachers a large raise, but they should also account for rising pension costs.

- Seek local funding to cover pension costs. Local sources of revenue, such as education foundation donations or tax increases, can contribute to inequities among low- and high-wealth districts, the Pivot Learning report noted. But they can also help cover pension costs. The report gives the example of one district that passed a parcel tax for just that purpose.

Talk of a bailout

In the current crisis, Democrats have been pushing for a federal pension bailout as part of another stimulus package, but Roza said that would be “tough politically.”

Randazzzo suggested states phase in increasing contributions to pension funds over time and adjust their policies “to assume less risk.”

“These adjustments will allow states to balance their commitments to people today and public retirees tomorrow,” he said. “Phasing in the cost increases will also give the economy time to recover and make the fiscal pain more manageable.”